Government Shutdown Took Real Estate on a Wild Ride

You know what question I’ve heard nonstop lately? “So… how’s real estate holding up for you?” Whether it’s a Republican in office, layoffs or the shutdown, we hear this a lot. And considering the government is the largest employer in the entire DC metro – nearly one in four local workers – the market is probably in freefall right now, right? Well…there are some twists here.

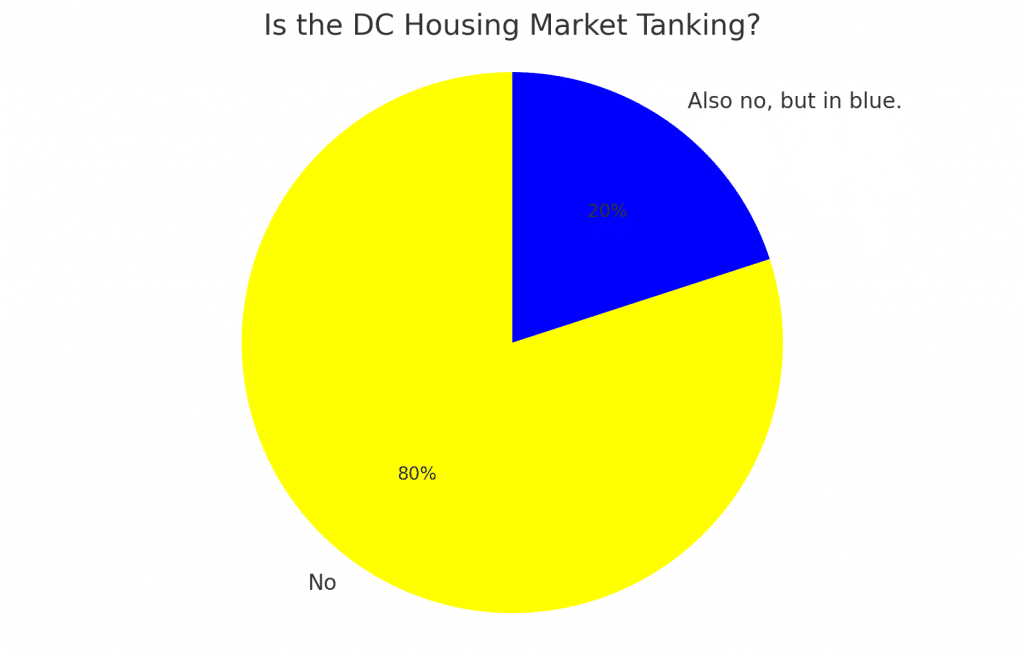

So, is the government shutdown tanking the DC housing market? If you’re a visual person, I’ve made a chart to better explain things.

The short answer is “it depends, but mostly no.” People are surprised by this. Let’s talk about why the answer is no. And this isn’t just me saying that things aren’t crashing because this is how I make my living. I have multiple sources I am going to cite here. The main takeaway is going to be this – DC is RESILIENT. Watch this.

The ground zero of where we gather our information is from the big daddy of them all – Bright MLS. This is where 98% of all listings are posted. It is what we as Real Estate Agents use to find homes for our buyer clients and where homes are listed for sale for our sellers. It is also what you, as consumers, view. But you get this information via a portal like Zillow or Redfin because there is no direct consumer access to MLS.

How are DC Area Buyers and Sellers Reacting to the Shutdown?

We’ll cover the topside stats first, which includes the entire region. New listings for the past month (October 2025) are up 6.3% over last year for the same time period. Zooming in to the weeks, new listings are down almost 15% over last week. Some of this is to be expected though as shifts this time of year are highly dependent on weather and how close we are to the holidays. I’m advising my seller clients to hold tight if they can, and we’ll list in the new year. Why? There’s no new-news here. It’s the same reason year after year. Demand naturally wanes by late fall. You can list a house now and struggle to get one decent offer or you can wait until January when a flood of buyers naturally come back into the market.

As of the last week of October, pending contracts are up 6.2% in the DC Area over last year. Last year, we had a different President, there were no teenage DOGE disciples using a magic wand to decide the fate of thousands of government employees, and there was no government shutdown. Consumer sentiment was better a year ago. But here we are, with pending contracts up 6.2%.

Urban Turf, a local e-news publication that reports on real estate, summed up the Bright MLS data for the housing market like this: It’s “cracking, but not fractured.”

Prices have held steady, even in areas that typically feel pressure first. Those areas are ones that are usually more geared to first-time buyers because of price point. But there is still pent-up demand. The buyer activity indicates that lower mortgage rates, more homes for sale and finally some room for negotiation have brought some off the sidelines. I have several buyers right now who are not affected by the shutdown. They are using this opportunity to secure a contract with terms more favorable to them than they would have been able to achieve in the past.

Is the Government Shutdown Killing the DC Real Estate Market?

I’ve been talking regionally so far, but this is a tale of two markets. Let’s look at each specific area – DC, Maryland or Virginia. DC is first.

Right now, inside the city limits, the market is very slow. The city seems to be affected by many factors. Bright MLS cites more recent events like the National Guard Presence in August 2025 and the government shutdown in October, 2025 as prime factors affecting the market in the city. The truth is, the city has been struggling since Covid. That was the first strike when people decided they wanted more space and yards and thought remote-work was here to stay.

But it didn’t end there. No, there was a parade of events that happened that landed us where we are now.

By 2023, people were not moving back into DC. And if they HAD thought about it, they quickly un-thought about it. The homicide and carjacking numbers skyrocketed – hitting all-time highs. At the end of 2024, Trump was re-elected. Then in January came DOGE layoffs, summer brought us the National Guard and October brought a shutdown.

PEOPLE HOW MUCH MORE CAN WE TAKE? I’ll be 100% honest with you though, as I always am. Today shall be no different.

1) I don’t care what anyone says, we needed the National Guard. Yes, there was outrage. There were protests. There was a lot of complaining that we need to be able to govern ourselves. I do not disagree, in theory. But, when you have 10 -15 year old car jackers who are stealing cars by gunpoint, joyriding, then totaling them, and get a slap on the wrist, we needed help.

2) The National Guard were not deployed around the city though, in a meaningful way. August 29 from ABC: “SE DC Residents Question Federal Troop Deployment as Violence Persists in Wards 7 & 8.”

Quick lesson on Wards. DC has 8 Wards. Wards 1-6 are on the west side of the Anacostia River. Wards 7 & 8 are east of the river. East of the Anacostia homes are priced significantly lower than the rest of the DC. This area has suffered with more crime compared to the other wards, though there are some exceptions. Wards 7 & 8 have some really great, leafy, suburban feeling neighborhoods – some with fantastic city views and little crime. Then, west of the river – Columbia Heights is in Ward 1 is one of the highest crime areas in the entire city. This isn’t me spouting nonsense. We have DC Crime Maps. You can look them up. I even did a whole video on how to navigate our Crime Maps.

In DC, new purchase contracts are down 12% compared to last year and showing appointments are down almost 15%.

What’s the Government Shutdown Doing to Maryland and Virginia Real Estate Markets

Northern Virginia Buyers are still showing up. Showings are up 6-7% in Arlington, Alexandria and Fairfax County.

Buyers are still out. They’re still writing offers. And yes, they’re still competing – especially for anything remotely move-in ready or in a prime location. Shutdown or not, people still need homes. Babies are still being born. Families are relocating. Jobs are still transferring people into this market. And we’re still short on inventory.

I’m not in the $3M+ “luxury” market, but the agents in my company who are universally report that there’s no change there. Things are still moving at the same pace as they have in the past. That’s to be expected though, right? Those are people usually in the private sector, not in government or government contracting positions.

I’m working with several buyers in Maryland right now. When it comes to new construction, things are selling slower. Builder incentives run the gamut, and it’s ultra-important to price everything out because of what I call the “Builder Shuffle.” They offer this awesome sounding credit of $20,000 or $30,000. But what they don’t tell you is they aren’t paying any closing costs. You as the buyer are paying all of it. And you have to use their lender to get that money. And their lender is exorbitantly expensive, so they find ways to recover that money anyway.

Right now, I’m really cautioning people against new builds. Not all builders are created equal. I’m seeing that the builders who have land development in-house have better pricing than those who buy finished lots from developers. It’s a weird disparity for sure. The builders are also reporting foot traffic is down, so watch for added incentives there.

In the Maryland resale market, about half of what I see with clients has a contract within the week. In Virginia, things aren’t lasting long enough to go see them.

When I work with sellers, right now I am telling them if selling is the most important issue, then they have to price aggressively so they don’t sit on the market. With buyers, I am encouraging them to enjoy the time to take a breath and think overnight instead of making quick decisions – but don’t think for too long because there are enough other buyers out there who can snap it up.

Why Isn’t the DC Area Real Estate Market Crashing?

Resilience! The DC metro market is one of the most resilient in the country.

Federal instability? We live with it. It’s baked into our market cycle like humidity in August.

What really drives our market isn’t fear, it’s fundamentals:

- Limited housing inventory

- High demand in desirable neighborhoods

- Strong school systems

- Walkability, commute times, and quality of life

And when people find the right house?

They’re not putting the brakes on because of congressional drama. There are a lot of smart people here and they know that this too, shall pass.

We’ve seen shutdowns before. This isn’t our first rodeo. This is, however, the longest one we’ve seen. Yes, there’s anxiety in the air – especially in a region like DC, where a quarter of jobs are tied to the federal government. But right now, the data is showing a dip in pace, not a plunge in prices. So here’s my advice whether you’re buying or selling.

Buyers:

Don’t let headlines distract you from a solid opportunity. It might be your window to get into a neighborhood that’s normally hyper-competitive. I’m looking at you, Bethesda, Maryland.

Sellers:

Don’t panic. Yes, pricing matters more right now than anything else, but so does condition. Buyers are cautious but not gone. If your home is staged, well-priced, and in good shape, you will get activity.

And if it’s not? That’s a strategy conversation we need to have.

0 Comments